Medical Student Loans: Your Complete Guide

It comes as no surprise that doctors often graduate from medical school with mortgage-sized student loans. According to a study from the Association of American Medical Colleges (AAMC), nearly 73% of doctors reported having education debt. The median medical school loan balance for new grads in 2020 was $200,000. But there are many of you out there strapped with much higher debt loads in the $300-$500k+ range.

Med student loan debt is even more burdensome among younger doctors, as tuition costs have continued to skyrocket over the years. Unfortunately, salary increases have not been commensurate with tuition increases, putting some doctors in an even more precarious position with respect to their medical school loan debt.

Paying for medical school can get overwhelming quickly. There are federal loans and private loans with different rules, eligibility, and repayment plans. There’s private refinancing, consolidation, forbearance, etc. Just figuring out what this stuff means might require hours and hours of research poring over student loan literature. But don’t worry, SLA can help walk you through it.

If you need help understanding the terminology, check out our Student Loan Terms glossary.

Med student loans can impact a doctor’s ability to:

- Save for retirement

- Purchase a home

- Get married or have children

- Attend medical appointments

- Pay off credit cards

- And much more

StudentLoanAdvice.com (SLA) was created to provide a third-party option to help doctors, dentists, and high earners save money on their student loans. Our team of student loan experts have met with hundreds of doctors making them some of the most knowledgeable in the industry. The student loan landscape is growing more complex each day with a multitude of repayment plans and loan forgiveness options—each with varying advantages and disadvantages which touch on your income, tax-filing status, and even how you’re contributing for retirement. It’s no surprise that many of our clients, prior to our consultations, were making five- and six-figure mistakes through mismanagement of their student loans.

For a few hundred dollars, we’ll meet with you one-on-one, review your situation, and provide you with a customized student loan plan to help you optimize your student loan management.

This post discusses some of the basics of student loans for medical school, repayment plans, and student loan debt forgiveness options.

Table of Contents:

- How do student loans work for medical school?

- How much student loan money should I borrow for medical school?

- How do I receive medical school loans?

- Loan companies for medical school

- What is a student loan servicer?

- Paying for medical school: federal vs. private student loans

- Federal student loans

- Types of federal student loans

- Federal repayment programs

- How to enroll into a federal repayment plan

- How much will my student loan payment be?

- How do I lower my monthly payment on medical school loans?

- Private student loans for medical school

- Student loan management for doctors

- Student loan forgiveness for doctors

- Refinance medical school loans

- Conclusion

How Do Student Loans Work for Medical School?

Medical school student loans are issued to med students to finance their education and associated living expenses. They are not to be used for any other purpose. Unlike a mortgage or auto loan, creditors have no direct asset to seize if you default. As such, they tend to be offered at rates significantly higher than mortgage rates, usually around 5%-8%.

Student loans are almost never discharged in bankruptcy. However, sometimes they will be discharged due to death or total and permanent disability. They can also be discharged if your school closes before you complete your program or if the institution defrauds you and other students.

How Much Student Loan Money Should I Borrow for Medical School?

Don’t borrow more money than you need for medical school. Financial aid offices may recommend taking out additional loans to cover living expenses. If this is needful in your situation, take out the least amount necessary to cover your living expenses. Some of your friends may borrow more than they need to live a lavish lifestyle on their loans. This is never a good idea.

Every dollar of loan money you spend ends up costing you more by the time you pay it back. Live, but be mindful that the gallon of milk you just bought actually cost you $15 or the steak dinner really cost $300.

How Do I Receive Medical School Loans?

Your medical school’s website or financial aid office will direct you to the federal student aid form or FAFSA form to receive student loans. After filling out the form, federal student aid will provide you with details on your financial aid package.

Prior to receiving federal student loans, you’ll complete entrance counseling and sign a legal document called a master promissory note in which you promise to agree to the loan obligations. If you have additional questions, contact your school’s financial aid office.

Financial aid offices may offer other types of federal and non-federal loans but it varies by institution. Learn more about non-federal loans below.

Loan Companies for Medical School

Student loan lenders are usually the government, a school, or a private lender. If you apply on FAFSA for a student loan, you will receive a student loan from the federal government. Currently, the majority of federal student loans are called direct federal student loans. Studentaid.gov is the home website where they have all of your loan information.

Your med school can lend to you directly through institutional loans and/or Perkins loans. These loans are not as common as direct federal student loans or private loans issued by private lenders.

If you want to receive additional loans, you’ll need to contact a private lender. A private lender is typically a bank or financial institution that will issue loans for education. Private loans have less flexibility and protections than federal loans.

Although federal loans come from the federal government, it typically outsources the loan servicing. Loan servicers manage the day-to-day aspects of your loan payments. Unlike federal loans, private lenders will typically issue and service your student loans.

What Is a Student Loan Servicer?

A student loan servicer oversees the administration of your student loans. Your servicer will keep track of your monthly payments, forgiveness credits, late payments, applicable tax forms, payment history, etc. Periodically, your student loan servicer can change. You will be told via email or snail mail when this happens. Make sure you log in regularly to ensure your contact information is up to date.

Paying for Medical School: Federal vs. Private Student Loans

Whenever possible, we recommend you take out federal student loans before private loans when paying for medical school. There is no limit on how much you can borrow federally for medical school. In addition, federal student loans tend to have lower interest rates initially and a plethora of federal protections that private student loans don’t offer. Such as:

- Income-Driven Repayment (IDR) – payment based on income

- Public Service Loan Forgiveness (PSLF) – 10-year tax-free loan forgiveness

- Taxable Income-Driven Repayment Forgiveness – 20-25 year taxable loan forgiveness

- Death and Disability Discharge – student loans are discharged tax-free in the event of death or total and complete disability

- Forbearance – temporarily putting federal student loan payments on hold while private loans offer little to no flexibility if you can’t make your payments

Federal Student Loans

Federal student loans are the most common type of loans med students borrow to finance their education. They come with a variety of loan types, repayment plans, and loan forgiveness options. Most US medical schools will qualify for federal student loans, but for those who attend medical school outside of the US will most likely have to look to the private sector for student loans.

Subsidized vs. Unsubsidized Federal Student Loans

Subsidized federal student loans don’t grow or accrue interest while you are in school. Subsidized loans were discontinued for medical school programs in 2012, and they are now only offered at the undergraduate level. Those who attend medical school now or who are planning to attend will have to utilize unsubsidized loans. These loans begin accruing interest the moment you receive them.

Types of Federal Student Loans

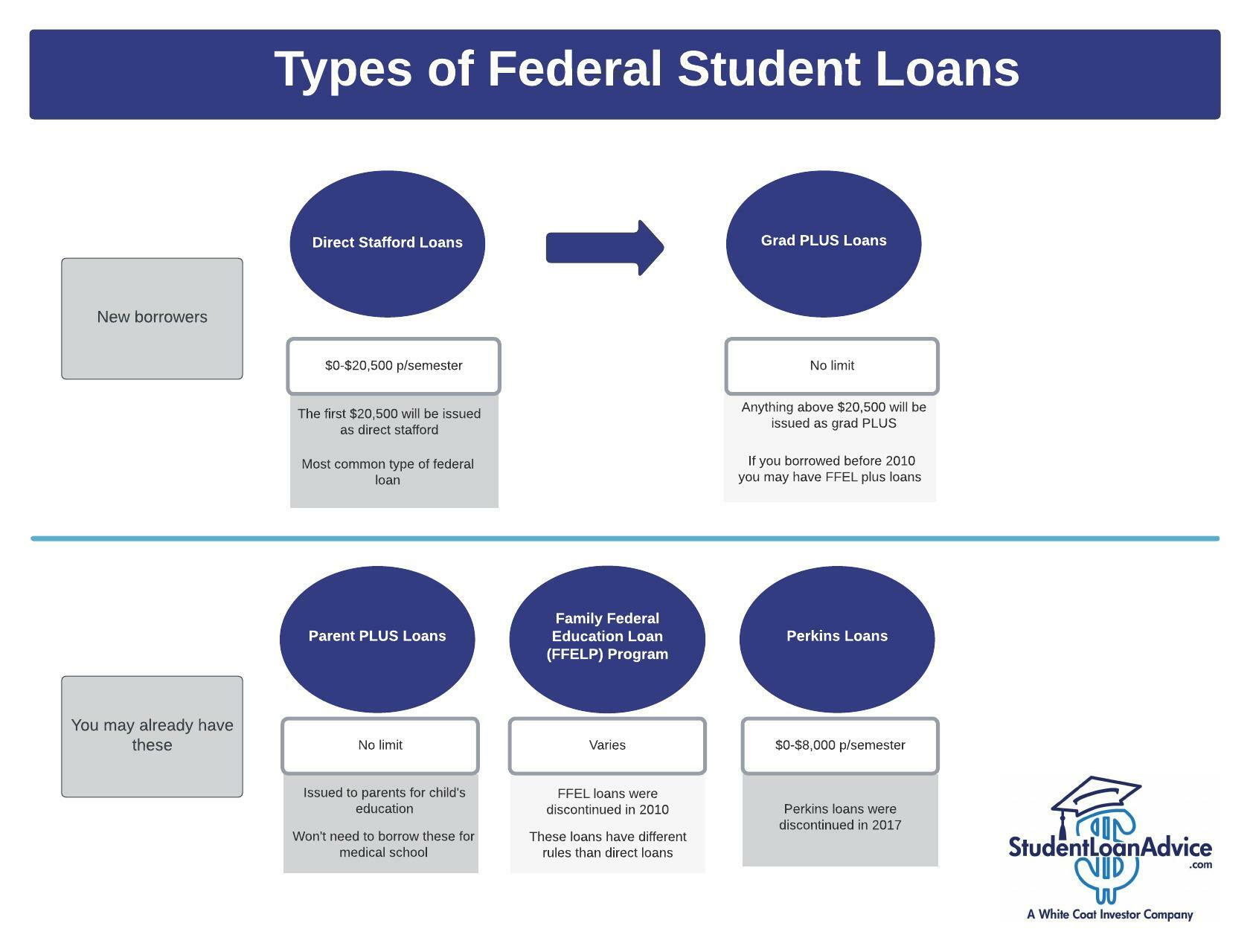

There are five main types of federal student loans to consider.

New borrowers mainly need to understand two loan types, direct Stafford loans and grad PLUS loans. When you are borrowing for medical school the first $20,500 per semester will be direct Stafford loans. If you need loans above that amount they will issue you grad PLUS loans. Grad PLUS loans are issued with a higher interest rate and loan fees than direct Stafford loans. Grad PLUS loans have no borrowing cap. Those who have already borrowed for medical school (and for other schooling) likely have a mix of the below loan types.

Direct Stafford Loans

Stafford Loans originated from the William D. Ford Federal Direct Loan (Direct Loan) Program. Direct Stafford Loans are the most common student loans and are currently being issued to help cover the cost of higher education.

Grad PLUS Loans

Grad PLUS Loans, aka Graduate PLUS Loans, come from the Direct and Family Federal Education Loan (FFELP) programs. Borrowers are issued these loans to cover tuition after exhausting Stafford Loans.

Parent PLUS Loans

Parent PLUS Loans are issued to parents to finance their child’s education. They are offered for undergraduate, graduate, and professional degree students. Parents will usually take out these loans if their child can’t cover their tuition through federal student loans. Parents are liable for the loans and ultimately responsible for them. There is no cap on federal borrowing for graduate and professional degree programs so you shouldn’t ever have to use these when borrowing for medical school.

Family Federal Education Loan (FFELP) Program

Before 2010, the Family Federal Education Loan (FFELP) Program was the main source of federal student loans. The program ended in 2010, and it’s now defunct. Almost all federal loans are now issued under the Direct Loan program referred to above. But for those who still have these older loans, there are different rules applicable to this loan program.

Perkins Loans

The Federal Perkins Student Loan program was created to provide money for college students with lower income or exceptional financial need. The program ended on September 30, 2017.

Perkins Loans all have a 5% interest rate and are issued by the school you attend. They are subsidized and won’t accrue interest while enrolled in school.

Health Resources and Services Administration Loans (HRSA)

Aside from the most common federal student loans listed above, the Health Resources and Services Administration (HRSA) also issues student loans exclusively to US healthcare professionals who demonstrate a financial need pursuing their healthcare education. HRSA loans are need-based and come with service requirements which encourage borrowers to practice in underserved communities. All of these loans are subsidized (government pays interest during school) and have a 5% fixed interest rate. Each has its own repayment terms, forgiveness, and deferment eligibility.

Federal Repayment Programs

There are a number of federal repayment plans to consider when determining which repayment plan is best for you. Standard, Graduated, and Extended repayment are based on your loan amount, length of repayment, and interest rate. Income-Driven Repayment is based on your income and household size.

- Standard Repayment Plan – fixed payments over 10 years

- Graduated Repayment Plan – payments start at a lower amount and increase every two years at a rate to pay off the loan over 10 years

- Extended Repayment Plan – fixed payments over 25 years

- Income-Driven Repayment (IDR) Plans – payments are calculated as a percentage of discretionary income. IDR plans are a requirement for Public Service Loan Forgiveness (PSLF).

More on Federal Student Loan Repayment Programs

How to Enroll into a Federal Repayment Plan

Your loan servicer will send you a notification to enroll into a repayment plan when you graduate. If you don’t select a plan, you’ll be in the standard 10-year plan. If you’d like to be placed in the graduated or extended repayment plan, call your loan servicer and request to be placed on that plan.

Most borrowers with federal loans should enroll into an IDR plan. REPAYE or PAYE are the best IDR plans. You may also need to consider Old IBR and ICR. If you’d like to enter an IDR plan, you’ll need to fill out an Income-Driven Repayment Application form. There is an electronic and paper form application.

If you’d like assistance with picking a repayment plan, schedule an appointment with a student loan pro.

How Much Will My Student Loan Payment Be?

Your student loan payment can depend on a variety of factors, such as your repayment plan, income, household size, tax filing status, etc. Here’s a calculator to help you find out how much your payment would be.

Bonus Tip: There are a number of Federal Student Loan Statuses you need to be aware of to ensure you don’t pay extra in the long run or eliminate the opportunity for forgiveness.

How Do I Lower My Monthly Payment on Medical School Loans?

Payments on loans for medical school can be lowered in a number of ways for both federal and private student loans.

Federal Student Loans

-Enroll in an Income-Driven Repayment (IDR) plan instead of the standard 10-year, graduated or extended repayment plan.

-Private refinance your federal student loans into a lower interest rate. Typically, this should provide you with a lower payment.

Private Student Loans

-Extend your loan term.

-Private refinance your loans to a lower interest rate.

-Add a co-signer with strong credit when you private refinance your student loans. Note, the co-signer becomes jointly liable for the debt if they co-sign.

Methods to reduce monthly payments in Income-Driven Repayment Plans

-Contribute to pre-tax accounts, such as a 401(k), 403(b), 457, TSP, Health Saving Account (HSA), and Flexible Spending Account (FSA).

-File taxes as a couple married filing separately (MFS)—learn more about this strategy here.

Private Student Loans for Medical School

Private Student Loans are typically taken out by students who have maxed out their federal borrowing limit for the year when borrowing for undergrad. With graduate and professional degree programs, there is no cap on federal borrowing. Federal student loans should always be taken out before private.

Eligibility Requirements for Private Student Loans

Most borrowers will receive private student loans from a private lender. If you decide to take out a private student loan, an underwriter will look at your credit score, debt-to-income ratio, savings, and job history to determine your creditworthiness. Most need to be a US citizen, permanent resident, or have a co-signer who is. Also, you must be of legal age to borrow. This varies by state.

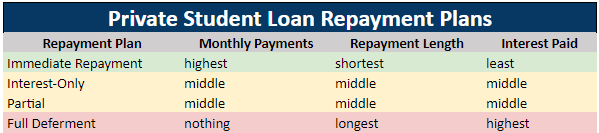

Private Student Loan Repayment Plans

There are four main ways to pay off your private student loans. Be advised: the longer your payment term, the more interest you’ll end up paying.

- Immediate Repayment – monthly payments begin based on a five-, 10-, 15-, or 20-year term. This is the lowest cost option of the four repayment options.

- Interest-Only – monthly payments only covering the interest.

- Partial – generally an option for those who are still in school or training who would like to make a low fixed payment. Note, this is very common during training.

- Full Deferment – not required to make payments in school, but it’s the most expensive option of the four.

More on Private Loan Repayment and which option to choose

Student Loan Management for Doctors

For most doctors, it is recommended to consider loan forgiveness or private refinancing. Going down either of these routes is more advantageous than sticking with a standard, graduated, or extended repayment for federal student loans. If you are considering loan forgiveness, you’ll most likely need to consider federal student loan consolidation. Skip this section if you just plan on private refinancing.

Federal Student Loan Consolidation

Federal student loans can be consolidated. During this process, numerous loans are all lumped together into one loan (or two in some cases), and the interest rates are averaged and then rounded up to the nearest 1/8th of a percent. This is distinct and different from the process of private refinancing, where the interest rate is generally lowered and loans are converted from federal to private.

Financially, sometimes the advantage of completing a direct federal consolidation is that it makes you eligible for different repayment plans and forgiveness options. If you’re a new grad or soon will be, a direct federal consolidation can allow you to opt out of the automatic six-month grace period that you’ll enter when you graduate. This would allow you to start paying your loans sooner and begin credit to loan forgiveness earlier.

Please note: when you complete a consolidation, it will erase your prior payment history on your loan(s). This is an important consideration if you’re doing loan forgiveness. This rule will be changed beginning July 1st, 2023. When you consolidate your direct student loans, they will take a weighted average of existing qualifying payments toward PSLF. Here’s an example under the proposed rules: say you have 100k of loans at 90 months and 100k of loans at 30 months. If you consolidate them you would have a new qualifying payment count of 60 on all of your loans.

Student Loan Forgiveness for Doctors

Most student loan forgiveness programs that doctors should consider are for federal student loans.

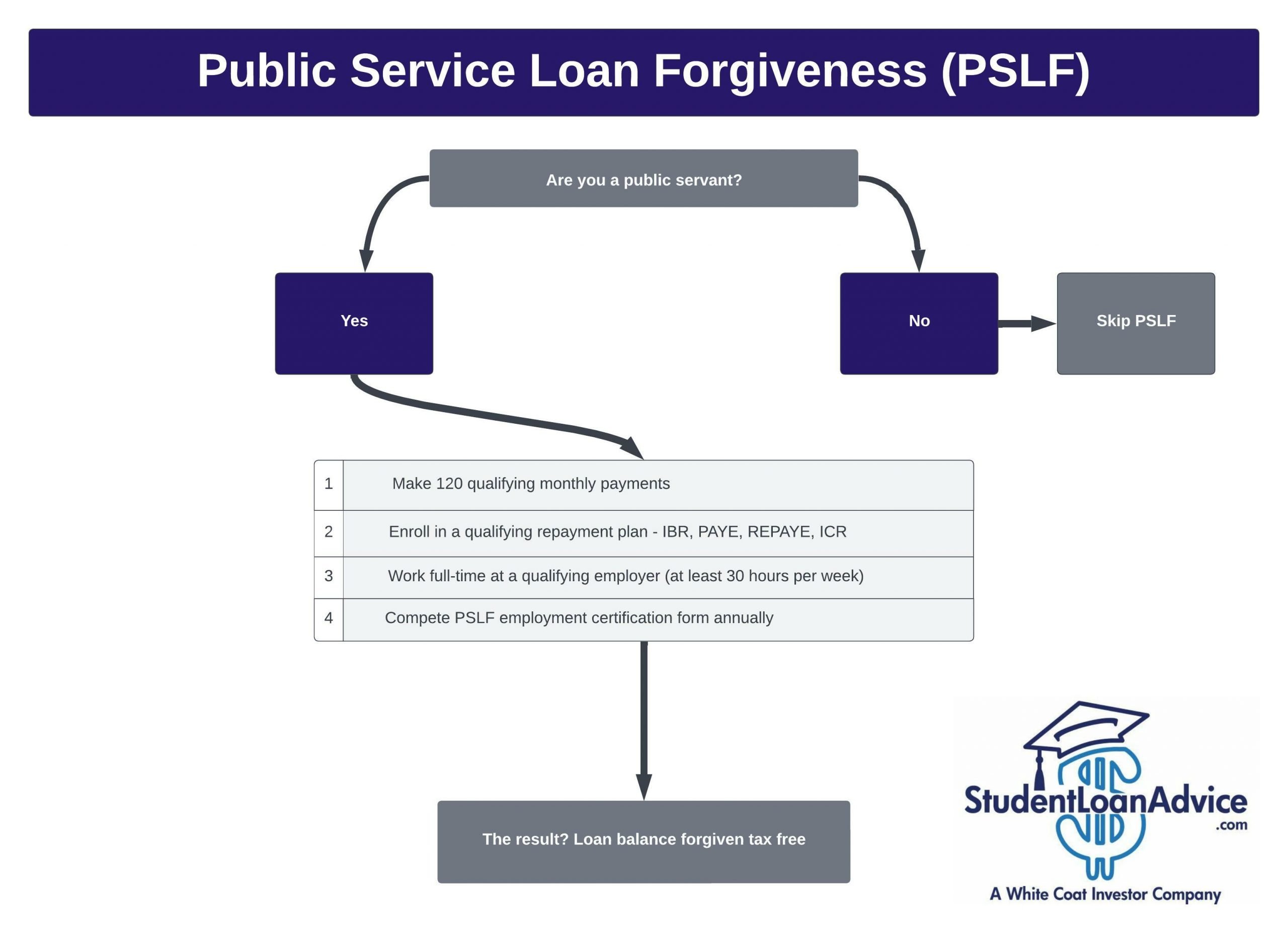

Public Service Loan Forgiveness (PSLF)

Public Service Loan Forgiveness or PSLF is the best loan forgiveness program out there. If you qualify, you should definitely consider it.

Who Is Eligible for PSLF?

Generally speaking, any borrower is eligible who works for a nonprofit organization or for the government. Use the PSLF help tool to determine if your employer qualifies.

What Types of Loans Are Eligible for Forgiveness?

Direct federal loans (unsubsidized and subsidized), direct graduate PLUS, and direct consolidation loans are eligible for PSLF.

What Are the Requirements of PSLF Loan Forgiveness?

- Make 120 qualifying monthly payments. These are cumulative payments, not consecutive.

- Enroll in a qualifying repayment plan—IBR, PAYE, REPAYE, ICR, or the standard 10-year repayment. Note: if you enroll in the standard 10-year payment plan and make payments for 10 years, there will be nothing left to forgive.

- Work full-time at a qualifying employer or the equivalent of full-time across multiple agencies or organizations (at least 30 hours p/wk). Qualified employers tend to be the government and nonprofits. Be careful as employers will sometimes be for-profit but affiliated with a government or nonprofit entity. FMLA will count if you don’t take more than 12 weeks and continue to make monthly payments.

- Have direct federal student loans, as mentioned above.

- Submit a PSLF certification form to verify your employment at a qualified employer and keep track of payments. It is advisable to submit this form at least annually to help servicers keep track of payments. A residency program director, fellowship director, HR manager, etc., would be able to sign it.

How Much Can Doctors Have Forgiven Through PSLF?

Any outstanding loan amount (principal and interest) will be forgiven tax-free after you have completed 120 qualifying payments. You will receive a refund if you’ve paid more than 120 payments on direct loans.

Please note that you need to be extremely meticulous with your record-keeping and ensure your loan servicer is correctly categorizing (or counting) each of your monthly payments. Completing the PSLF certification form annually is the best way to mitigate your servicer’s errors. Your servicer will likely make mistakes on your application, and you’ll need to correct them.

How Long Does It Take to Have Loans Forgiven Through PSLF?

PSLF takes about 10 years to complete.

Please note: There is a temporary relaxation of a number of these requirements. Read about it here.

Taxable Income-Driven Repayment Forgiveness

Taxable Income-Driven Repayment Forgiveness is another option for doctors who are ineligible for PSLF and have student loan debt 3, 4 or 5x+ their income. We almost never recommend any doc pursue this program. If you’re a doctor who doesn’t qualify for PSLF but has huge amounts of debt and is considering this forgiveness program, schedule a time with a professional at SLA.

Who Is Eligible for Taxable Income-Driven Repayment Forgiveness?

Borrowers enrolled in income-driven repayment programs are eligible.

What Types of Loans Are Eligible?

Direct federal loans (unsubsidized and subsidized), direct consolidation loans, Parent PLUS loans if consolidated (ICR only), and FFEL loans.

What Are the Requirements?

Be enrolled in an income-driven repayment program. Make monthly payments. Complete the annual income-driven repayment (IDR) certification.

How Much May Be Forgiven?

The outstanding loan amount will be forgiven after you have completed the payment term. The forgiven amount will be taxed for borrowers receiving this forgiveness after 2025. The taxed forgiven amount is often referred to as the “tax bomb” because the taxes paid in the year the loans are forgiven can be massive. The tax bomb makes this program much less appealing unless you save up for it along the way. Set up a side fund to prepare for the tax bomb. This is an account where, periodically (generally advised monthly), you’ll contribute money to an investment account of your choice to set aside enough money to pay the tax bill in the year your federal loans are forgiven.

How Long Does Taxable Income-Driven Repayment Forgiveness Take?

- REPAYE – 20 years for undergrad, 25 years for graduate.

- PAYE – 20 years.

- IBR – 25 years (20 years for borrowers who took out loans after July 1, 2014).

- ICR – 25 years.

If you’d like to explore additional forgiveness options, please see our post on Student Loan Forgiveness Programs.

Refinance Medical School Loans

The goal of refinancing medical school loans is to lower the interest rate on your student loans and to pay less interest. You can refinance federal and private student loans together.

Federal Student Loans

If you’ve decided student loan forgiveness is not right for you, you should definitely consider private refinancing. Don’t hold on to those high federal student loan interest rates (6%-8%) longer than needed.

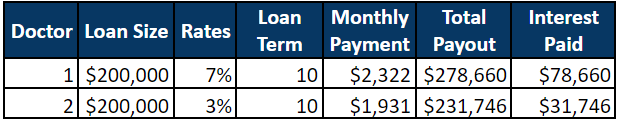

Here’s an example of two doctors:

Doctor 1: med student loans 200K, interest rate 7%, 10-year term

Doctor 2: med student loans 200K, interest rate 3%, 10-year term

Doctor 2 made lower monthly payments and, in total, paid $46,914 less in interest

Private Student Loans

Anytime you can receive a lower interest rate by private refinancing, it is recommended you do so to pay the minimum amount on interest. Private lenders will look at your credit, job history, income, savings, and debt. The better you are in each of these categories, the better rate you will generally receive. Make sure to check out rates during these inflection points in your career.

- Medical school graduation to resident

- Resident to attending physician

- Make partner in your practice

- Marriage to another earner

Loan Repayment Assistance Programs (LRAPs)

Loan repayment assistance programs (LRAPs) are programs which help pay down your federal and private student loans. There are many LRAPs available to borrowers if you work in specific states, join the military, work in a high-need area, and much more.

See our guide on LRAPs to learn more.

Conclusion

If your head is spinning after reading through this guide, you’re not alone. This was the case when we first learned about this stuff, too. It’s tricky and nuanced, and it can be stressful when deciding how best to manage your student loans. This explains why we often identify five- or six-figure mistakes our clients were making prior to their consultation with us.

Schedule your consultation with us at StudentLoanAdvice.com, and you’ll receive a customized student loan plan that will save you hours of research and stress and potentially thousands of dollars. Start down the path toward financial independence by letting us guide you through your best student loan options.

Are you ready to tackle your student loans?

Join our community of doctors, dentists and high earners. Each month you’ll get our FREE newsletter with all the tips and tricks to help you save $$ on your student loans.