The public service loan forgiveness program (PSLF) is a federal loan forgiveness program created in 2007 to help public servants pay off their student loans. PSLF has encouraged borrowers nationwide to select a fulfilling career in public service. PSLF allows a borrower to pay only a portion of their overall balance and have their loans forgiven tax-free after a decade of payments. Public service borrowers will often pay significantly less on their loans by pursuing PSLF.

If you are a borrower with student loans and interested in public service, we recommend you to look into the program.

Table of Contents

- How does the public service loan forgiveness program work?

- How much will PSLF forgive?

- Is PSLF retroactive?

- PSLF during COVID-19 Pandemic

- What recent changes have occurred with PSLF?

- What is temporary expanded PSLF?

- Has anyone received PSLF?

- How to decide if PSLF is right for you

- Will PSLF go away?

- What if I don’t qualify for PSLF?

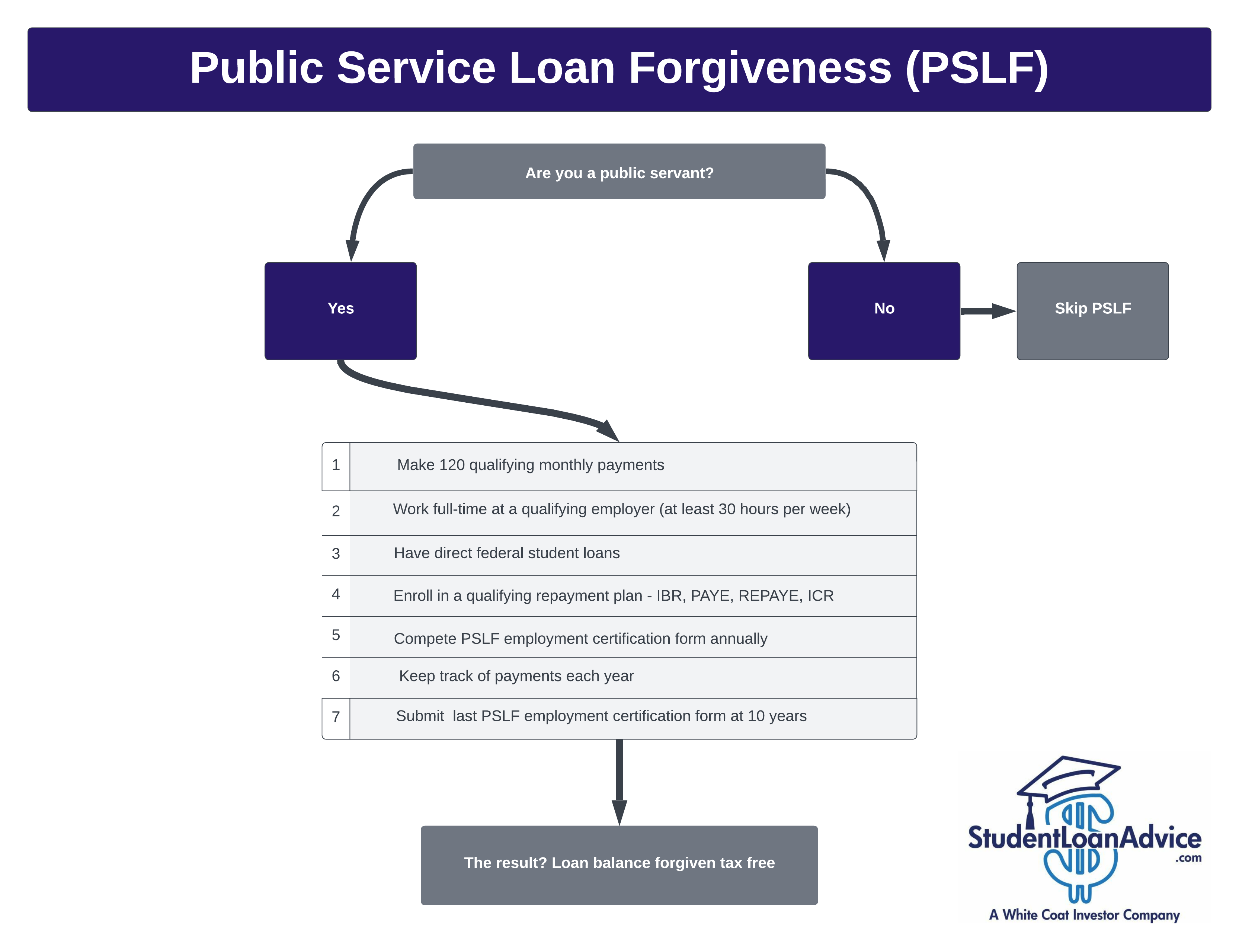

How Does the Public Service Loan Forgiveness Program Work?

The public service loan forgiveness program requires you to work in public service for a decade. At the end of ten years your loans are forgiven tax-free.

How to Apply for the PSLF Program

Here’s the seven steps you need to follow to ensure you’ll be eligible for PSLF when you hit 10 years of employment.

1.) Make 120 Monthly Payments

The first requirement of the PSLF program is to make 120 monthly payments. These need to be on-time at the required monthly amount. You can make lump sum payments as well but we recommend sticking to monthly payments to keep things simple for your servicer. These payments don’t have to be consecutive. This is 120 cumulative payments. So, if you take time off for the birth of a child or temporarily leave public service you can pick up where you left off.

2.) Qualifying Employment

Qualifying employers for PSLF are generally nonprofit organizations, 501(c)(3)s or government agencies. You need to be working full-time or a minimum of 30 hours per week at multiple qualifying institutions for your employment to qualify.

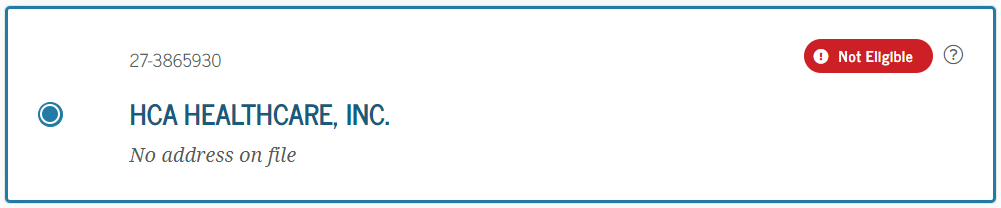

The easiest way to verify if your employer qualifies is to use the PSLF help tool. The help tool requires your employer’s employment identification number (EIN) to look up your employer. Your EIN is on your W-2.

Here is an example of a qualifying employer

Here’s an example of an employer that does not qualify

HCA Healthcare or Hospital Corporation of American Healthcare is a common organization we run across that doesn’t qualify.

In some cases you might even run into a situation where it is in the middle like this.

If you do see this that says “likely ineligible”, you’ll have to submit documentation explaining why your employer qualifies.

We used Northwestern Mutual strictly as an example. However, we know it is a for-profit company and would not qualify as an eligible employer for PSLF.

3.) Direct Federal Student Loans

You need to have direct federal student loans to qualify for PSLF. Direct federal student loans are:

- Direct Stafford loans (unsubsidized and subsidized)

- Direct PLUS graduate loans

- Direct consolidation loans

If you have federal loans that have a different name such as perkins, federal family education loans (FFEL), etc., these would not be eligible for PSLF. To make those loans eligible you are required to complete a direct federal consolidation.

4.) Qualifying Repayment Plan

It is required that you make payments in a qualifying repayment plan to receive credit for PSLF. Qualifying repayment plans are income-driven repayment (IDR) plans and the standard 10 year repayment plan.

Income-driven repayment plans are:

- Revised Pay As You Earn (REPAYE)

- Pay As You Earn (PAYE)

- Income-Based Repayment (IBR)

- Income Contingent Repayment (ICR)

You should select the plan that has the lowest required minimum payment to optimize PSLF. See our guide if you need help selecting your repayment plan.

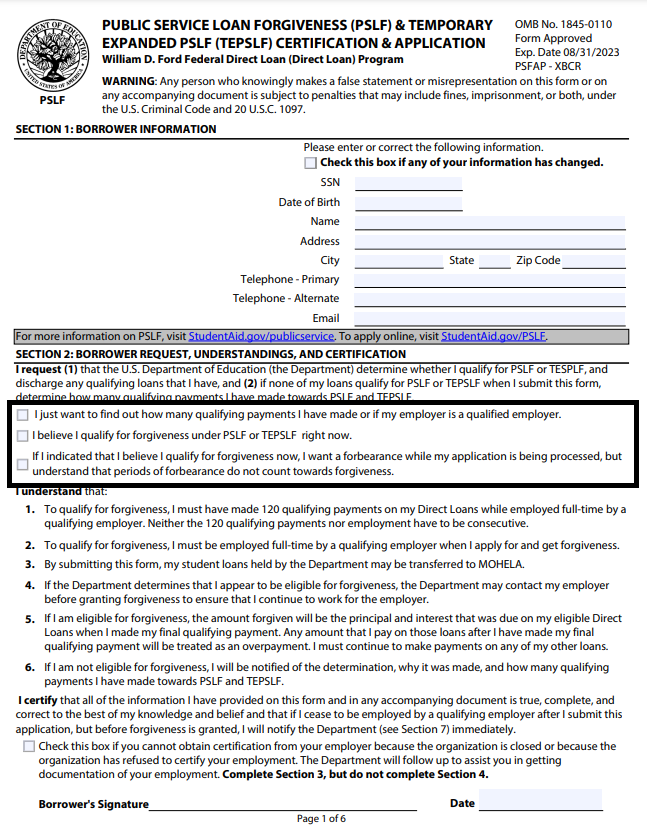

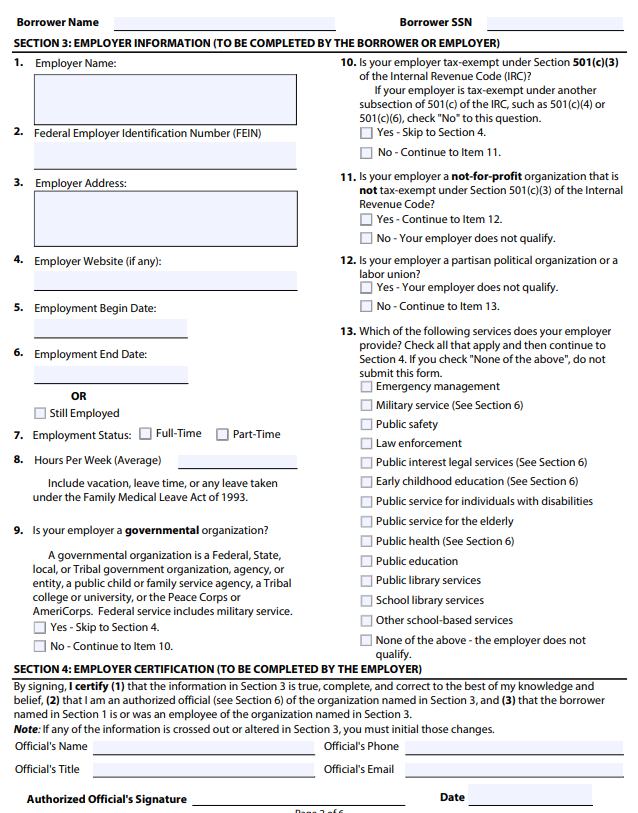

5.) PSLF Employment Certification Form

The PSLF employment certification form is required to verify you work at a qualifying employer. There is no automatic process that knows you are at a qualifying employer and making payments in a qualifying repayment plan.

Here is the application form

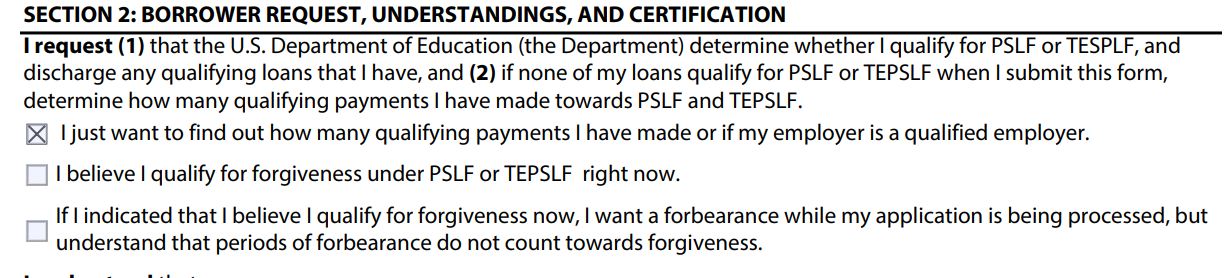

Fill out the top right regarding your personal information. Next, you need to check a box in Section 2 which we have boxed above. If you are in years 1-9 of PSLF then check the first box.

I’ll cover the other categories later when you hit 10 years.

Here’s page #2 of the application

On page two you need to fill out key details about your employer, when you started working (and ended if applicable), and the hours you worked. Recall, you need to be full-time or working at multiple qualifying employers for a minimum of 30 hours per week.

Some employers will even fill this out for you. Our personal favorite way to do this is to let the PSLF help tool do it for you. If you follow the prompts on the PSLF help tool it will allow you to a.) verify your employer qualifies and b.) fill out the entire form so you don’t have to handwrite or type it in and c.) generate a form for each employer. This is particularly helpful if you have multiple employers. Each employer needs a page # two of its own.

Next up is section four. This part has to be signed by your employer. The form lists the person eligible to sign as an “authorized official.” Simply put, this can be your boss, manager, human resources, payroll manager, program director, board chair, etc. Typically, you need a wet signature on the form. You can email the form to a past employer if they are no longer a short drive from you..

Obtaining employer signatures can take time. Especially if it’s for a previous employer. Recently, the Department of Education has updated the PSLF help tool to facilitate obtaining employer signatures. It will send notifications for when your employer has signed the form.

After they have signed it in dark ink (yes they are specific on the color) the last step is section 7, where to send the form. Now all you need to do is mail/fax/upload it to MOHELA. MOHELA is the only federal loan servicer that handles borrowers doing PSLF.

If your loans are not serviced with MOHELA, you’ll need to mail or fax it. Our preferred method there is to send it certified mail. Your current servicer will move your loans to MOHELA as part of the process.

If MOHELA already services your loans, use the file upload. We like this best because it keeps a digital record of the form and your submission date. It will be quite helpful when you are looking back a year or years later trying to remember when you last submitted your PSLF form.

It is good practice to complete a PSLF form once per year.

6.) Keep Track of Payments Each Year

Easier said than done. Our rule of thumb is once a year download the bank statement where you have set up your ACH or automatic payments with your loan servicer. Banks usually don’t keep great records of transactions beyond five years back. You don’t want to be in a situation where your servicer is haggling with you on a past payment and you can’t pull up the bank documentation to support your claim. Keep all the past bank statements and PSLF certification forms in a folder on your computer. It may come in handy someday.

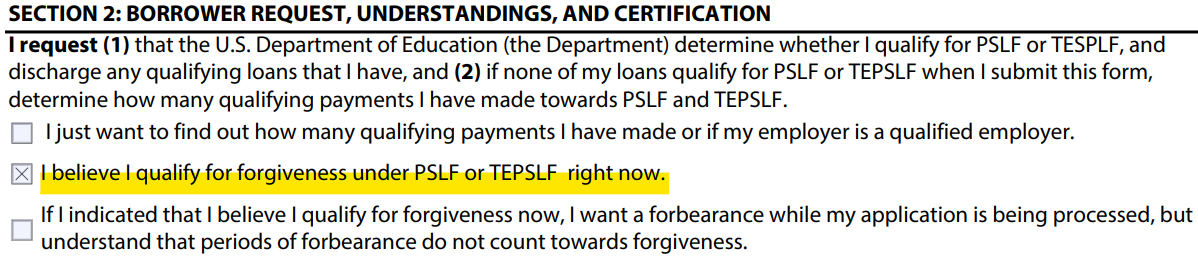

7.) Submit Last PSLF Form at 10 Years

When you have hit the magic 120 qualifying payments or 10 years, you are ready to submit your last PSLF form (HOORAY). When you submit your last form make sure you check the second box on page one.

This will notify your servicer that you believe you have reached the 10 years.

One point we cannot highlight enough: At the time of forgiveness you still need to be working at a qualifying employer, working qualifying hours in a qualifying repayment program. Any payments you make beyond the 120 on your direct loans will be refunded back to you.

How Much Does PSLF Forgive?

PSLF currently does not cap the amount of loans forgiven. Any interest and principal balance owed in direct federal loans would be eligible for forgiveness once you have fulfilled the requirements.

Is PSLF Retroactive?

Yes, PSLF can be obtained retroactively. By nature, in order to certify for the program you need to have past employment history that would qualify. For example, I begin working at a non-profit in January. The following January, I complete the PSLF certification form and submit it to my servicer. The loan servicer would grant credit from when I started working to the date the form was signed, which in this case would be 12 months. Thus, credit can only be applied for past employment that would qualify.

Here’s a caveat. At the time of forgiveness, you still need to be at a qualifying employer and in a qualifying repayment program. You cannot receive PSLF if you are at a non-qualifying employer. So, don’t complete your 10 years, submit your last form and quit your qualifying job. Make sure you receive your forgiveness, which should be 2-3 months after submission, before you jump ship (if that’s what you’re planning to do).

PSLF During COVID-19 Pandemic

During the COVID-19 pandemic the federal government issued a pause on interest and payments for direct federal student loans back in March 2020. In addition, all of the months in this government mandated forbearance will count towards your 120 if you are working at a qualifying employer and are in a qualifying repayment program. Monthly payments during the pandemic are set at zero dollars until the loan moratorium expires. If you have made any payments during the pause, you can call your servicer and request a refund of any payments.

What Recent Changes Have Occurred With PSLF?

The public service loan forgiveness program has recently had a couple of waivers and changes that have assisted borrowers looking to receive forgiveness.

PSLF Waiver

The PSLF waiver was the first waiver introduced to help borrowers with PSLF. This waiver was temporary in nature and lasted from October 2021 to October of 2022. The waiver relaxed program requirements helping many older borrowers to receive credits and reach forgiveness. The PSLF waiver assisted hundreds of thousands of borrowers to receive PSLF.

IDR Waiver

The IDR waiver was the second waiver that came along in April of 2022. Similar to the PSLF waiver this relaxed program requirements for borrowers. However, it is vastly different in that it impacts all borrowers rather than just those who are in public service. This waiver lasts until December 2023. Here’s more information on the IDR and PSLF waiver.

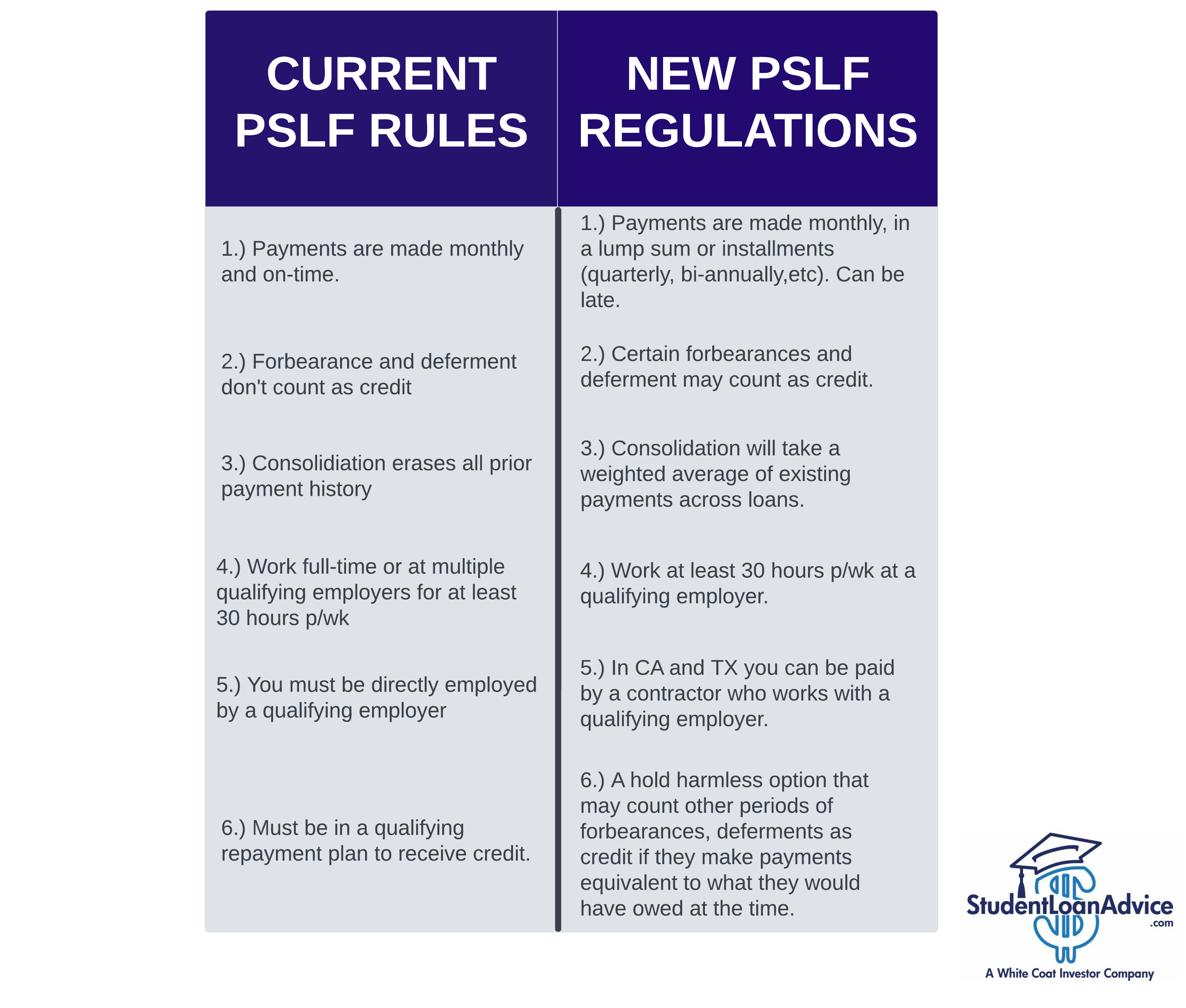

Permanent Changes to PSLF

The permanent changes to PSLF were brought about when President Biden issued an executive order in October of 2022. The changes flew under the radar after President Biden announced broad student loan forgiveness up to $20,000 for borrowers in August 2022.

These permanent improvements will go into effect July 1, 2023, barring there isn’t a lawsuit that tries to block it. Here are the newest regulations:

- Allow borrowers to receive PSLF credit on late payments, installments or in a lump sum. Currently, the rule requires you to make the required payment for that month or a lump sum up to your next recertification date. This resolves the issue for those who receive some type of loan repayment assistance program from your employer or a supporting entity like NIH, VA, NHSC, etc.

- Count certain forbearance or deferment periods. The majority of these relate to military service and administrative or mandatory forbearances (like the COVID pause).

- When you consolidate your federal student loans, they will take a weighted average of existing qualifying payments toward PSLF. Under current PSLF rules when you consolidate, you lose ALL prior progress to forgiveness. Here’s an example under the proposed rules: say you have 100k of loans at 90 months and 100k of loans at 30 months. If you consolidate, you would have a new qualifying payment count of 60 on all of your loans.

- Adopt a 30-hour work week requirement as qualifying employment. Currently, the rule is 30 hours per week at multiple jobs or whatever your employer categorizes as full-time (down to 30 hours).

- “Allow a qualifying employer to certify employment for a contractor if that individual is providing services that by State law cannot be filled or provided by an employee of that organization.” This appears to be specific for doctors contracted at nonprofit hospitals in Texas and California. The current rule requires you to be directly employed by a 501(c)(3) or non-profit. Here’s our deep dive on this.

- “Borrowers will be able to access a hold harmless option to have other periods of deferment and forbearance potentially counted toward PSLF if they make payments equivalent to what they would have owed at the time. This includes getting credit for periods during which the borrower would have had a $0 payment.” Our first thought, if your loans were in grace period right out of school (your default status unless you consolidate your loans right after graduation) you’d likely get credit for those months as forgiveness.

These new regulations could improve your ability to receive forgiveness. If you’d like to dig more into the details here’s the factsheet.

PSLF Reconsideration Application

Did your loan servicer make a mistake on your PSLF application by denying months in repayment or validating your employer? You’re not alone.

The PSLF reconsideration application is one of the ways to fix your payments for PSLF. The application requires they reevaluate your situation. The application takes about five minutes to complete. Have your employer documents ready for submission and be prepared to state your case for why they have erred. It is helpful to attach any applicable letters from your servicer.

What is Temporary Expanded PSLF?

The temporary expanded public service loan forgiveness program or TEPSLF is a flavor of PSLF. It was created to provide relief to borrowers who have worked in public service but were denied PSLF. Prior to applying for TEPSLF, you must first apply to PSLF and receive a denial letter.

TEPSLF has one different rule from PSLF. You can be enrolled in a non-qualifying repayment program and qualify. However, for the last 12 months leading up to your 120 payments you need to make a payment that would be at least as large as it would’ve been if you were on an IDR plan.

TEPSLF has a limited amount of funds and is provided on a first-come, first-served basis. It will dry up and go away at some point and should be pursued as soon as possible if you haven’t qualified under PSLF.

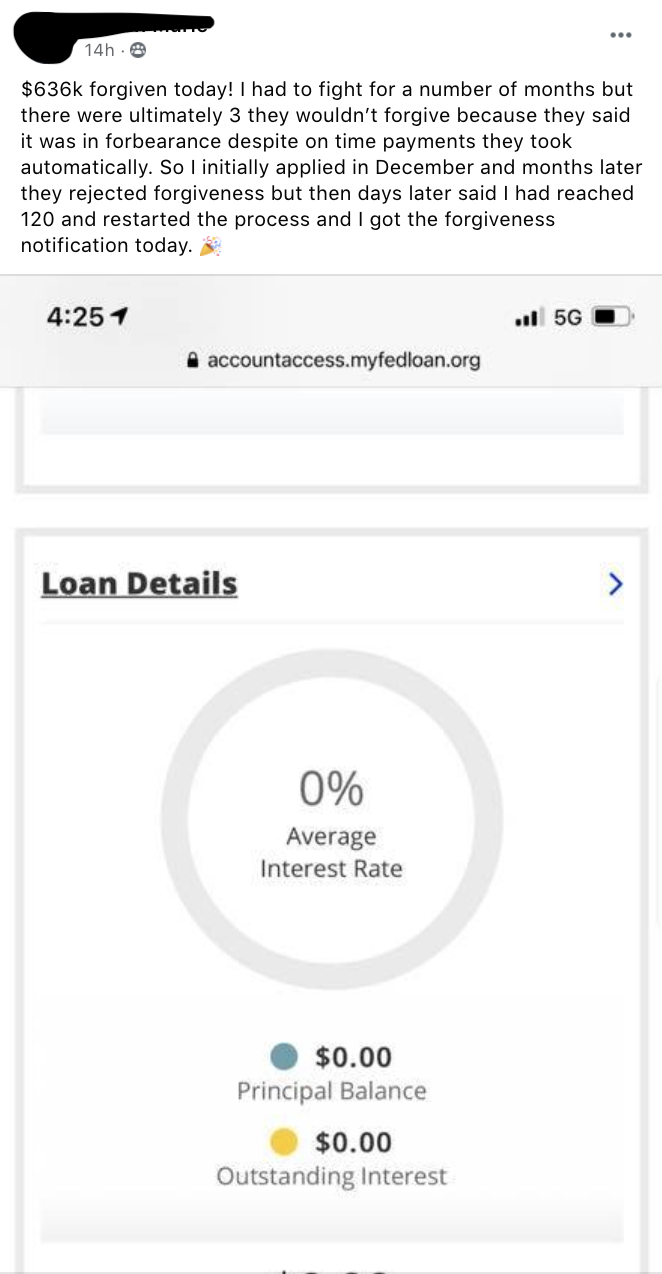

Has Anyone Received PSLF?

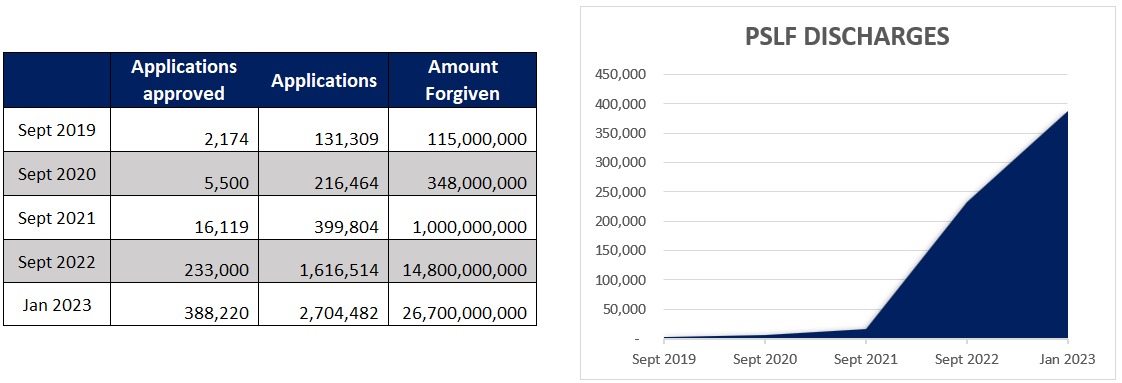

Yes. Hundreds of thousands of borrowers have received PSLF. PSLF has had a recent spike in success due to some of the temporary waivers and increase in applicants. Through January 2023, 388,220 borrowers have received PSLF. The total amount forgiven via PSLF is $26.7 billion. Here’s a rundown over the years of applicants and those approved.

Although applicants approved has increased dramatically, when you take a closer look in January 2023, we see ~2.7M applied and only 388k or so were approved. That’s 15%.

Most people take that at face value and believe it means only 15% of borrowers are receiving PSLF. However, of the 2.7M applicants, most have not accumulated 10 years of employment. Yes, they are counting those applicants in years 1,2,3, all the way up to 10. By listing all applicants to those approved it severely dilutes the perceived rate of success for PSLF.

Many articles have been written on this premise to downplay the success of PSLF. For a lot of borrowers, it has successfully driven them away from pursuing PSLF altogether. This was particularly relevant in the early days when there were only a few thousand approved.

For the data on public service loan forgiveness to become more accurate, there should be a metric showing the number of applicants who met requirements over a decade and are awaiting their final word on forgiveness. This compared to applicants approved would be a better measure of the program’s success. If borrowers were seeing numbers thrown around like 98% success rates, there would be far more applicants considering the program.

How to Decide if PSLF is Right for You

The decision to pursue PSLF depends on many factors. Here’s three we think are most significant.

1.) Are you planning to work at a non-profit, 501(c)(3) or government organization?

2.) Are you planning to work full-time?

3.) Do you owe (in student debt) more than you make?

If you answer yes to all three questions, you should definitely pursue PSLF. It is highly likely it would save you money on your loans.

If you answer yes to the first two questions and no to question three, you’re probably better off not pursuing PSLF. There are some unique cases for those of you who work in medicine and pursue lengthy training periods where you are paid significantly less for your first 3-7 years out of school and then experience a huge jump in income. If you are in this boat, it may make sense for you to do PSLF. You should schedule a consult with one of our experts.

If you answer no to the first two questions and yes to the last, maybe it’s time you reconsider your job choice and pursue a job in public service…just kidding. There are alternatives for you detailed later in the post.

Is the PSLF Program Worth it?

The PSLF program is worth it for many borrowers. If you work in public service or will in the future, you’ll almost always pay less using PSLF than an alternative method of repayment.

More info

–The (Nearly) Perfect PSLF Situation for a Physician

Will PSLF Go Away?

A question we receive on every consult we do is will PSLF go away? Since PSLF is a government program there is always risk the program could be modified or go away in its entirety. However, we don’t believe this would be the case for existing borrowers.

PSLF for Existing Borrowers

If you are an existing borrower, the likelihood of PSLF going away is extremely unlikely. When federal loan programs have changed in the past, those already in them have been grandfathered into the old programs.

PSLF for New Borrowers

For new borrowers or those yet to borrow, the PSLF program could change. But, we don’t see this going through Congress for some time as they would need a two-thirds majority vote or bi-partisan support. Both sides of the aisle are quite divided on student loan policy right now.

Our prediction is the PSLF program may come with a phaseout determined by income similar to tax credits. Most of you are high-earners (or soon to be) and are not eligible for most tax credits. We could see them implementing a phaseout at $200,000 of income. The amount forgiven is another easy target for lawmakers to change. Currently, there is no cap on the amount of student debt that can be forgiven. They could implement a cap on how much in student debt you’d be eligible to have forgiven. Amidst policy uncertainty for the future, PSLF is still a path you should consider even if you have yet to borrow any loans.

What if I Don’t Qualify for PSLF?

If you don’t qualify for PSLF, don’t fret. There are alternative methods to pay down your student loans and you’ll still save money.

Taxable Forgiveness

Taxable forgiveness or IDR forgiveness is a federal forgiveness program similar to PSLF but with less rules. We are not fans of taxable forgiveness because borrowers have to pay over 20-25 years and are taxed on the loan balance forgiven. Public service loan forgiveness is half the time and loans remaining are forgiven tax-free. Borrowers may consider taxable forgiveness if their student debt is 2.5x or more than their income. If you are strongly considering taxable forgiveness, there are many variables to consider. We recommend meeting with one of our student loan experts to help you run the numbers.

Private Refinancing

Private refinancing is an extremely common method for borrowers looking to pay less on their student loans. Many borrowers will privately refinance their loans if they aren’t going to do PSLF because it allows them to lower their interest rate. Here’s our guide on private refinancing to help you determine if it’s right for you.

Other Forgiveness Options

Your forgiveness options for student loans are not solely limited to public service loan forgiveness or taxable forgiveness. Sometimes, you can even mix and match them like we see commonly for those in medicine employed by the VA and military. Additionally, there are a variety of loan forgiveness opportunities to borrowers who work in underserved communities and particular states.

We have successfully advised many borrowers to reach public service loan forgiveness. As of today (March 2023), our clients have had over $5M in student loans forgiven from PSLF! There is no better feeling for us than when we see you succeed and save money on your student loans.

If you are considering PSLF or need help deciding if it’s right for you, with potentially hundreds of thousands of dollars at stake, don’t go at it alone! Rest assured, our team of student loan experts will be able to clear up any questions you have to ensure success in obtaining PSLF.

Contact our team of student loan experts today!

Are you ready to tackle your student loans?

Join our community of doctors, dentists and high earners. Each month you’ll get our FREE newsletter with all the tips and tricks to help you save $$ on your student loans.