How Does Married Filing Separately Affect Student Loans?

Tax season is upon us. Will my tax filing status change my student loan strategy? This is a common question we hear in student loan consults, particularly this time of year.

For those who are married or looking to marry within a few years, it is important to understand how your tax filing status can significantly change your student loan plan.

Traditionally, most households file their tax return using married filing jointly (MFJ) status. Below we will discuss when you should consider filing your return using married filing separately (MFS) status and how this could potentially save you hundreds to thousands of dollars in the long run.

Not interested in doing a deep dive and want an expert to help determine which filing status will save you the most money? Book a consult today!

Table of Contents

- Married Filing Jointly vs Separately

- Pros and Cons of Married Filing Jointly

- How Do Income-Driven Repayment Plans Affect Your Tax Filing Decision?

- When Should Married Couples File Taxes Separately?

- Married Filing Separately in Community Property States

- The Bottom Line: Tax Filing Status is Integral to Maximizing Your Student Loan Plan

Married Filing Jointly vs Separately

Married couples have two options in filing their taxes, married filing jointly or married filing separately. In order to be eligible to file taxes as married, the couple needs to have wed before the end of the tax year. How you choose to file your taxes can greatly affect your student loan payments.

What Does Married Filing Separately Mean?

Filing taxes married filing separately means that each spouse files their taxes separately (two returns instead of one). Each return is based on that individual’s income.

What Does Married Filing Jointly Mean?

Filing taxes married filing jointly means that a single combined tax return is filed for household income.

Pros and Cons of Married Filing Jointly

Most CPAs and tax software will recommend that you file your taxes married filing jointly over married filing separately because you will pay less in taxes, you only have to file one return (instead of one for each spouse), and there are more deductions and credits.

Benefits of Married Filing Jointly

When filing taxes married filing jointly, some of the potential deductions and credits that are possible include the:

- Earned income tax credit

- American opportunity and lifetime learning education tax credits

- Exclusion or credit for adoption expenses

- Child and dependent care tax credits

Disadvantages of Married Filing Jointly

There are a few downsides to consider as a married couple filing taxes jointly through a MFJ filing status such as a:

- Inability to exclude spouse’s income from student loan calculation

- Smaller deductions for medical costs if it exceeds 10% of adjusted gross income

Generally speaking, for dual earners with similar incomes, MFS doesn’t cause much of a tax penalty. But, for a typical household, MFJ results in less paid taxes and is more simple.

So the question is, why would I ever file my taxes married filing separately? Well, for student loans there are a couple of reasons you need to be aware of which may save you thousands of dollars. Let’s dive in.

How Do Income-Driven Repayment Plans Affect Your Tax Filing Decision?

In order to understand how filing status impacts your student loans, let’s first dive into what an Income-Driven Repayment (IDR) plan is.

What is Income-Driven Repayment?

Here are a few basic definitions and explanations about Income-Driven Repayment (IDR).

An Income-Driven Repayment plan adjusts your payment amount in a way that is to be affordable based on your current income and family size.

Income-Driven Repayment Eligibility

There are four income-driven repayment plans available to student loan borrowers. Revised pay as you earn (REPAYE), pay as you earn (PAYE), income-based repayment (IBR) and income-contingent repayment (ICR).

Income-Driven Repayment Plan Summary

Monthly Payments Required by Income-Driven Repayment Plans

Discretionary Income = Adjusted Gross Income (AGI) minus 150% of poverty threshold for your family size (HHS Poverty Line)

- For REPAYE, PAYE, & IBR, discretionary income is the amount by which your AGI exceeds 150% of the poverty threshold for your state and family size

- For ICR, discretionary income is the amount by which your AGI exceeds the poverty threshold for your state and family size

How to Calculate Discretionary Income For Income-Driven Repayment

Family size is determined by how many children are in your home including any unborn children who will be born during the year. Children must receive more than half of their support from you to be claimed in your family size.

Poverty Threshold

The Department of Health and Human Services (HHS) poverty guidelines, which are a simplified version of the Census Bureau’s poverty thresholds used for program eligibility purposes, are the same for the 48 contiguous states and the District of Columbia. Due to Office of Economic Opportunity administrative practices beginning in the 1966-1970 period, there are separate poverty guidelines for Alaska and for Hawaii.

When Should Married Couples File Taxes Separately?

There is much to consider when choosing your tax filing status and there is not a one-size-fits-all solution. However, it is often the case that married filing separately can save duel-income married couples a lot of money. Consider the following scenarios:

The Perez Family

Maria and Santiago Perez are newly married and pregnant with twins. Maria earns $60,000 per year as a resident and owes $500,000 in federal student loans. This is her second year in residency and she has made 1 year of IDR payments.

Santiago earns $125,000 per year as an associate orthodontist, owes $200,000 in federal student loans and works for a private practice. He is two years out of residency and has made 5 years of IDR payments.

Maria is interested in going for PSLF and could possibly receive it in 9 years. Santiago hopes to buy into a practice but realizes that this would involve a practice loan, which would mean additional debt. Maria and Santiago are feeling overwhelmed about raising kids with $700,000 in student loans plus the practice loan that Santiago will need.

Let’s walk through four IDR scenarios to demonstrate a few tricks and how to save them money!

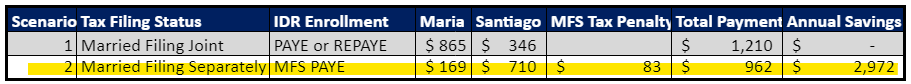

Scenario 1 MFJ – REPAYE or PAYE

AGI: Maria: $60,000, Santiago: $125,000 = $185,000

Tax Filing: Married Filing Jointly

Status: Married, 2 children (twins born this year)

Poverty Guideline = $26,500

IDR Plan: REPAYE or PAYE (10% of Joint Discretionary Income)

Discretionary Income: $185,000 – ($26,500 x 1.5) = $145,250

Monthly Payment:

- Attributed monthly to Maria’s loans ($145,250 x 10% / 12) x 71% = $865

- Attributed monthly to Santiago’s loans ($145,250 x 10% / 12) x 29%= $346

- Household monthly payment $145,250 x 10% / 12 = $1,210

By filing taxes MFJ, the monthly payment is distributed based on your % of loan balance.

Note, Maria’s loans are 71% of the overall loan balance and Santiago’s are 29% which is how monthly payments are attributed to their loans.

Annually $14,525 would be paid on their loans. With $10,375 applied to Maria’s and $4,150 to Santiago’s. Seems a bit counterintuitive as Santiago is making more money and more is allocated to Maria’s loans. It’s important to remember when filing taxes MFJ, they calculate your portion of the loan payment based upon your % of household student loans.

Negative Amortization Student Loans

Another important point is that in Revised Pay As You Earn (REPAYE), if your monthly payments don’t cover the monthly interest accrual, 50% of the unpaid interest is covered by an interest subsidy. The technical term for this is called negative amortization. The overall student loan balance grows slower if you’re enrolled in REPAYE during negative amortization.

Using our example, $700,000 in loans at a 6% interest rate grows at a rate of $42,000 per year. $14,525 is their required annual student loan payment leaving $27,475 in accrued unpaid interest for the year. 1/2 of this unpaid interest ($13,737.50) is paid for by a government subsidy. Calculations below:

- Annual Accrued Interest: $700,000 x 6% = $42,000

- Unpaid Accrued Interest After Student Loan Payment: $42,000 – $14,525 = $27,475

- Unpaid Accrued Interest After Government Subsidy: $27,475 X .5 = $13,737.50

- Outstanding Loan Balance: $700,000 + $13,737.50 = $713,737.50

Let’s look at how much they would be paying if they use MFS.

Scenario 2 MFS – PAYE

Maria and Santiago Perez both enroll in PAYE and file using MFS status. This allows them to exclude each other’s income from their student loan calculation. An added bonus is the poverty line deduction for their household of four is deducted from each of their individual discretionary income calculations.

AGI: Maria: $60,000, Santiago: $125,000

Tax Filing: Married Filing Separately

Status: Married, 2 children (twins born this year)

Poverty Guideline = $26,500

IDR Plan: PAYE (10% of Discretionary Income)

Discretionary Income:

- Maria $60,000 – (26,500 x 1.5) = $20,250

- Santiago $125,000 – (26,500 x 1.5) = $85,250

Monthly Payment:

- Maria’s monthly payment $20,250 x 10% / 12 = $169

- Santiago’s monthly payment $85,250 x 10% / 12 = $710

- Total monthly payment $169 + $710 = $879

Filing taxes MFS reduces their overall monthly payment by $331 per month compared to MFJ. This is an annual savings of $3,972.

Keep in mind, annual taxes paid would increase by approximately $1,000 ($83 per month) for the year by filing MFS. But, the net savings is $2,972 a year.

The overall cost savings is a critical calculation for each client to help them decide if MFS is most advantageous for their situation:

Scenario 2 Annual savings in student loans ($3,972) – increased tax burden ($1,000) = Overall cost savings ($2,972)

Scenario 3 MFS – PAYE/REPAYE

Maria and Santiago Perez file taxes MFS. Maria enrolls in PAYE and Santiago in REPAYE. Maria’s monthly payment will be the same as above ($169). We already calculated Santiago’s payment as well in the MFJ example above. In the calculations we’ll show a nuanced loophole that can reduce their payment.

AGI: Maria: $60,000, Santiago: $125,000

Tax Filing: Married Filing Separately

Status: Married, 2 children (twins born this year)

Poverty Guideline = $26,500

IDR Plan:

- Maria enrolls in PAYE (Payment is 10% of Her Discretionary Income)

- Santiago enrolls in REPAYE (Payment is 10% of Joint Discretionary Income)

Discretionary Income:

- Maria $60,000 – (26,500 x 1.5) = $20,250

- Santiago $125,000 + 60,000 – (26,500 x 1.5) = $145,250

Monthly Payment:

- Maria’s monthly payment $20,250 x 10% / 12 = $169

- Santiago’s monthly payment ($145,250 x 10% / 12) x 29% = $346

- Total monthly payment $169 + $346 = $629

Recall with REPAYE, you ALWAYS look at joint discretionary income regardless of tax filing status. With Santiago enrolled in REPAYE, his student loan payment is calculated from their joint discretionary income. However, he’s only held liable to his portion of the household student loan debt, which is 29%.

Essentially, 29% of the REPAYE monthly payment is due from Santiago. The other 71% isn’t charged to Maria because she’s in PAYE. Effectively creating a shield to block higher payment for Maria.

Scenario 3 would put an extra $7,340 in the Perez’s pocket annually.

Time to take a quick break on scenarios.

Married Filing Separately in a Community Property State

The scenarios above are for couples in common law states. If you live in California, Texas, Arizona, New Mexico, Louisiana, Nevada, Idaho, Washington, or Wisconsin you’re in a community property state. Couples in community property states who file taxes MFS have an even GREATER opportunity to lower their monthly student loan payment.

The main reason is how the IRS calculates your AGI. Unlike common law states, community property AGI isn’t the sum of both of your incomes. Instead, they equalize your income by summing your incomes together and divide it in half.

With a reduced household AGI you can expect a lower monthly payment for the higher earning spouse. On the flip side, this raises the AGI for the lower earning spouses and increases that portion of the monthly payment. Sounds like an overall wash for student loan payments as the high earner pays less and low earner pays more.

But wait, here’s the trick to help the lower earner keep a low payment. Next time you recertify your income use alternative documentation of income (pay stub) instead of your most recent tax return. They will base your student loan payment solely off your pay stub or income. Thereby, reducing your monthly student loan payment.

Here’s an example.

Scenario 4 MFS PAYE/REPAYE in a Community Property State

Let’s suppose Maria and Santiago Perez were living in Wisconsin, a community property state, filed taxes MFS and enrolled in IDR with Maria in PAYE and Santiago in REPAYE. There’s another loophole here, so pay close attention.

AGI: Maria: $60,000, Santiago: $125,000

Tax Filing: Married Filing Separately

Status: Married, 2 children (twins born this year)

Poverty Guideline = $26,500

IDR Plan:

- Maria enrolls in PAYE (10% of Her Discretionary Income)

- Santiago enrolls in REPAYE (10% of Joint Discretionary Income)

Community Property: Maria AGI $60,000 + Santiago AGI $125,000 = $185,000 / 2 = $92,500

Discretionary Income:

- Maria $60,000 – ($26,500 x 1.5) = $20,250

- Santiago $92,500 + $60,000 – ($26,500 x 1.5) = $112,750

Monthly Payment:

- Maria’s monthly payment $20,250 x 10% / 12 = $169

- Santiago’s monthly payment ($112,750 x 10% / 12) x 29% = $268

- Total monthly payment $169 + $268 = $437

Living in a community property state has reduced Santiago’s AGI. The reason is that in community property states, the law equalizes spousal income allowing Santiago’s income to drop from $125,000 to $92,500. Higher earning spouses in community property states can take advantage of lower student loan payments.

If Maria’s AGI was based on her tax return, her AGI would actually increase from $60,000 to $92,500. Effectively, increasing her discretionary income and student loan payment. We get around this by having her enroll in PAYE and submit income recertification with alternative documentation of income. Which allows her to report current income of $60,000 versus the $92,500 she’d report if using her tax return.

Scenario 4 annual savings in student loans ($9,276) – increased tax burden ($1,000) = Cash savings ($8,276)

The Bottom Line: Tax Filing Status is Integral to Maximizing Your Student Loan Plan

Here’s a flowchart to summarize what we’ve discussed and to help you quickly identify if married filing jointly or married filing separately is right for your situation.

Wow, we covered a lot of ground and just scratched the surface on how integral tax filing status is to your overall student loan plan and finances. Student loan repayment options are tricky for dual-income married couples but you can see that by paying close attention to nuanced details, you can save a significant amount of money.

Every couple’s situation is unique, and if you’re still wondering what the right filing status is to reduce your student loan payments, our student loan consultants are ready to help. Our team of experts will guide you through all your options to tackle your student debt and help you find your optimal student loan plan. Ready to save money and take the confusion out of your student loans? Book a Consult with our student loan experts today.