Student Loan Consolidation

There are two types of student loan consolidations, a federal and a private one. They are commonly confused as the same thing, but they are vastly different. Both can be beneficial to a borrower, but there are key differences you need to know.

Table of Contents

- Direct federal consolidation

- Private consolidation or private refinance

- Should I consolidate my student loans?

- How do I consolidate my student loans?

- How does consolidating student loans impact my payments?

- How does consolidating impact my interest rate?

- How does consolidating impact my credit?

- What student loans can be included in a direct federal consolidation?

- What repayment plans am I eligible for after a direct federal consolidation?

Direct Federal Consolidation

A direct federal consolidation is the process of combining two or more federal student loans into one. The federal government will pay off the existing loans you’d like to consolidate and will issue you a new direct consolidation loan. You can not consolidate a private and federal student loan together in a direct federal consolidation.

Borrowers will complete a consolidation to:

- Opt out of a grace period right after graduation to begin repayment earlier

- Become eligible for income-driven repayment (IDR) plans or public service loan forgiveness (PSLF)

- Lower their monthly payment

- Reduce the headache of keeping track of multiple loans

- Exit a student loan default

During the consolidation application, you will pick a new repayment plan which can have terms from 10-30 years. There also will be IDR options you can choose. More on this later.

Private Consolidation or Private Refinance

A private consolidation or private refinance consists of a private lender paying off one or more of your existing federal or private student loans and issuing you a new private loan with a new set of terms.

Borrowers will private refinance their student loans to:

- Lower their interest rate

- Change their loan terms

- Consolidate their monthly payments

Borrowers should only private refinance their loans if it ends up saving them money. If you’d like to learn more about private refinancing or private consolidation, see our private refinancing guide.

Should I Consolidate My Student Loans?

It depends on your strategy to pay down your loans.

If you plan on paying them off and not pursuing a federal student loan forgiveness program, we usually recommend a private refinance or private consolidation. It’s likely if you tap the private markets, the lender will offer a lower rate than what you borrowed previously for school.

If you’re planning on pursuing a federal student loan forgiveness program, we recommend you consolidate your loans right after graduation. Completing a direct federal consolidation means you will get a single, new loan in place of your old loans. If you made any payments prior to consolidation, those will be erased. New grads who consolidate right when they graduate begin repayment quickly after school and start paying down their loans and/or receiving credit for student loan forgiveness programs earlier than those who want to wait.

Note: Student loan consolidation rules will be changing beginning July 1, 2023. When you consolidate your direct student loans, they will take a weighted average of existing qualifying payments toward PSLF. Here’s an example under the proposed rules: say you have 100k of loans at 90 months and 100k of loans at 30 months. If you consolidate them you would have a new qualifying payment count of 60 on all of your loans.

How Do I Consolidate My Student loans?

To complete a direct federal consolidation, login to studentaid.gov, hover over “manage loans,” and select the option to consolidate your federal student loans. You can also click on this link to take you directly there. You can select to consolidate two loans or more. Most borrowers will include all their federal student loans in the consolidation. If you select an IDR plan, you’ll be required to include income information. This can be a tax return or a recent pay stub.

To complete a private consolidation or private refinance, see our guide.

How Does Consolidating Student Loans Impact My Payments?

Consolidating via a direct federal consolidation can help drop your monthly payment if you select an IDR plan or a longer repayment term.

The amount you owe will determine your repayment options and the terms in some repayment plans.

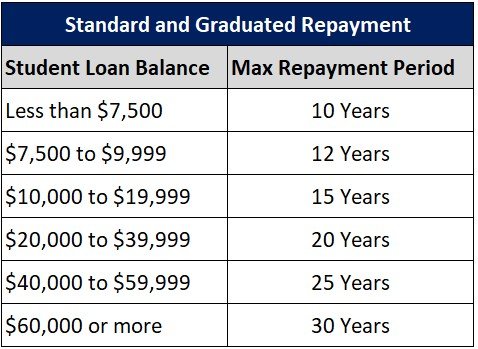

Standard and graduated repayment terms are based on how much you owe.

If you owe at least $30,000, you are also eligible for the extended 25-year repayment plan. Many borrowers will also consider IDR options.

Interested in figuring out your monthly payment? See our student loan calculator.

How Does Consolidating Impact My Interest Rate?

A direct federal consolidation will take a weighted average of the interest rates of the student loans you include in your consolidation and round it up to the nearest ⅛% (.125%).

If you private refinance your student loans, it purely depends on the interest rate the private lenders quotes you. It can be higher or lower than your existing interest rates.

How Does Consolidating Impact My Credit?

A direct federal consolidation will not impact your credit. However, if you have a loan in default, consolidating will move it out of default and on the path to recovering your credit.

A private refinance will drop your credit 10-15 points usually. Initial quotes or “soft pulls” won’t impact your credit.

What Student Loans Can Be Included in a Direct Federal Consolidation?

You can only include federal student loans in your direct federal consolidation. Here’s a list of eligible federal student loans.

- Direct Stafford unsubsidized

- Direct Stafford subsidized

- Direct PLUS graduate

- Direct consolidation

- FFEL Stafford unsubsidized

- FFEL Stafford subsidized

- FFEL PLUS graduate

- FFEL consolidation

- Parent PLUS

- National direct student loans

- National defense student loans

- Federal supplemental loans for students

- Auxiliary loans to assist students

- Health professions student loans

- Health education assistance loans

- Nursing student loans and nurse faculty loans

- Loans for disadvantaged students

- Federal insured student loans

- Guaranteed student loans

What Repayment Plans Am I Eligible for After a Direct Federal Consolidation?

Borrowers are eligible for standard and graduated repayment. If your loan balance exceeds $30,000 in direct loans and you didn’t borrow before October 7, 1998, you are eligible for extended repayment as well.

Borrowers interested in IDR would be eligible for

- Revised Pay As You Earn (REPAYE)

- Income-Based Repayment (IBR)

- Income-Contingent Repayment (ICR)

- Pay As You Earn (PAYE)—did not borrow prior to October 1, 2007, and has a loan disbursed after September 30, 2011

If you’re not sure which repayment plan to select after completing a direct federal consolidation, read our guide on federal student loan repayment plans.

Deciding on consolidation is an important step to pay down your student loans. For many, it will expedite your ability to receive federal student loan forgiveness or pay less in interest. Each borrower’s situation is unique and requires a careful approach to understanding if consolidation is requisite. If you are wondering whether consolidation is right for you, ask one of our student loans pros and get clarity on the best path forward for your situation.

Are you ready to tackle your student loans?

Join our community of doctors, dentists and high earners. Each month you’ll get our FREE newsletter with all the tips and tricks to help you save $$ on your student loans.