Private Student Loan Repayment Plans

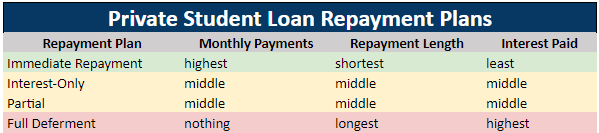

There are four main ways to pay off your private student loans. Private student loan repayment plans are generally more simple than federal student loan repayment programs. Be advised, the longer your payment term, the more interest you’ll end up paying.

Table of contents

- Immediate repayment plan

- Interest-only plan

- Partial interest repayment plan

- Full deferment repayment plan

- Which private student loan repayment plan should I use?

Immediate Repayment Plan

Monthly payments begin while you are still in school based on a five-, seven-, 10-, 15-, or 20-year term. This is the lowest cost of the four repayment options but is not commonly used for borrowers still in school. This option tends to be the best for borrowers out of school paying down their loans.

Pros of Immediate Repayment

- Pay the least amount of interest

- Out of debt earlier

Cons of Immediate Repayment

- Highest money payments

- Harder to fulfill other financial goals due to high monthly payments

Interest-Only Plan

While you are still in school, your monthly payments will only cover the interest on the loan. This is a good idea for borrowers who would like to get a head start on their repayment.

Pros of Interest-Only

- More affordable monthly payments

- Less loans to pay off when you graduate than if you deferred payments

Cons of Interest-Only

- You have to make payments, and, thus, you need income (or someone who can pay)

- Unable to make a dent in your loan’s principal balance

Partial Interest Repayment Plan

If you are still in school, this option provides a low fixed payment but does not cover all of the loan’s interest. This is common for physicians or dentists in training as a number of private lenders will allow them to pay $100 for up to four years while in training.

Pros of Partial Interest

- Affordable payments for borrowers early in their career

- Able to cover some of the interest to help in the overall repayment

Cons of Partial Interest

- Unable to keep up with the interest and the loan balance will grow

- Requirement to make payments in school or early in your career can be difficult

Full Deferment Repayment Plan

While you are enrolled in school, you are not required to make payments. This is the most expensive option of the four and common while in school.

Pros of Full Deferment

- No monthly payments required

Cons of Full Deferment

- Most costly of all repayment options

Which Private Student Loan Repayment Plan Should I Use?

Some of you may be recently graduated and unable to make large monthly payments following the immediate repayment method. It’s tough, but we advise you to start the immediate repayment method so you start paying down the principal balance and tackle your student loan debt as soon as possible.

This table helps you visualize the difference. Each loan was on a 10-year payment plan at 7% interest.

Immediate repayment started with monthly payments of $2,322.

Interest-Only made two years of monthly payments at $1,167, covering interest, and then moved to immediate repayment of $2,322/month.

Partial made two years of $100 monthly payments and then moved to immediate repayment of $2,322/month.

Full deferment made no payments for two years and then moved to immediate repayment of $2,322/month.

Not only does the completion year become more than the loan term by selecting options 2-4, but your total payout also increases because of the additional interest you’re required to pay.

The length it takes you to pay down your private student loans will determine the overall cost of your loan. The longer it takes you to pay off your loan, the more you’ll have to pay in interest. Sometimes, it is difficult to make a full payment, cover the interest, or even partially cover it. Having the option of making below a full payment can provide you with temporary relief and is necessary in some circumstances. In particular, those enrolled in school or in an early career internship or training period will opt for little to no payments early on. Making any payment is better than nothing. However, make sure your partial or no payments are temporary. Make a plan to begin full payment or immediate repayment as soon as possible.

If you need help navigating private student loan repayment plans, taking out private student loans, or private refinancing, schedule an appointment with one of our student loan pros.

Are you ready to tackle your student loans?

Join our community of doctors, dentists and high earners. Each month you’ll get our FREE newsletter with all the tips and tricks to help you save $$ on your student loans.