In July, The One Big Beautiful Bill Act (OBBBA) was passed into law and it includes changes that will reshape higher education and student loan management. OBBBA but could hit physicians and dentists hard with higher payments or longer repayment terms. While there are a few bright spots, like extra funding for loan servicers, increased Pell Grants and more accountability for colleges and universities, the student loan system is truly a mess.

In this post, I’m diving into what this means for doctors, dentists and other high earners. You’ll learn how new loan limits will impact those interested in medical or dental school, why PSLF is safe for current docs but tougher for new students and what changes are on the horizon for repayment plans.

New Loan Limits, Grad Plus and Subsidized Loans Elimination

The borrowing limits are being lowered for parent plus loans, graduate school and professional school. In graduate and professional school, many borrowers would utilize Grad Plus loans as part of their financial aid package to borrow up to the cost of attendance. Grad plus loans had higher interest rates than direct unsubsidized loans and didn’t have borrowing limits.

Starting on July 1 2026, new borrowers will not be eligible for Grad PLUS loans or subsidized loans for undergrads. Resulting in more interest growth on loans during undergrad and a higher likelihood of borrowing privately for expensive graduate programs such as medical or dental school. This could shut out first-generation or low-income students from graduate programs as private loans require stronger underwriting requirements.

Please note: There is a three-year exception for those who enrolled in a program of study as of June 30, 2026.

The limits for borrowing are capped at

- $100k for graduate school

- $200k for professional school

- $65,000 (per child) for parent plus loans ($20,000 per year)

Please note: students still in school who borrowed before July 1, 2026 will have three additional years of borrowing under the older standard, allowing borrowing up to the cost of attendance.

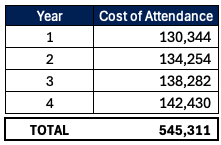

The only MD program in my home state is the University of Utah. Based on the 2024-2025 academic year for a Non-Resident On Campus, the cost of attendance is $130,344. It won’t take long for a medical student at the UofU to borrow up to that federal cap of $200k. Assuming tuition increases 3% per academic year this med student would borrow over four years ~$545,311.

Now, only $200,000 of that would be federal and the other $345k could end up as private loans. And, we aren’t even factoring in the interest rates of 6%-9% students are borrowing at these days. While in a four year program, the interest accrual alone could be six figures…

This shift could price out first-generation or low-income students, as private lenders have stricter requirements than federal programs. While Grad PLUS loans fueled tuition hikes, they also opened doors for diverse applicants. Now, aspiring doctors in lower-paying fields like primary care might rethink their careers. It’s a steep mountain to climb if you owe $300,000 + of private loans without the option for income-driven plans or public service loan forgiveness.

As less borrowing is offered federally, there will be less doctors who pursue the PSLF program.

Goodbye to ICR, SAVE/REPAYE and PAYE

The bill wipes out three of the four current income-driven repayment plans.

Repayment plans eliminated

- Income-Contingent Repayment (ICR)

- Saving on a Valuable Education (SAVE) – Previously known as Revised Pay As You Earn (REPAYE)

- Pay As You Earn (PAYE)

Repayment plans remaining

- Income-Based Repayment

For loans before July 1, 2026, only IBR will survive. Specifically the old version that bases payments on 15% of discretionary income. If you’re in ICR, SAVE or PAYE you’ll be moved into IBR. IBR will now drop the partial financial hardship requirement to enroll making it easier to enroll into. Be prepared to have a higher monthly payment as IBR is generally more expensive than PAYE and SAVE.

For borrowers who start taking out loans after July 1, 2026, you’ll have a different set of repayment options. Unfortunately, you will not be eligible to enroll into the IBR plan. The two payment plan options are:

- Standard Repayment and

- Income-Based Repayment Assistance Plan (RAP)

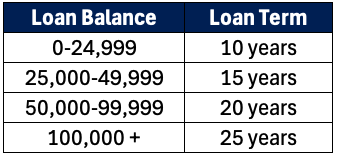

The standard repayment plan is not too different from the original time-based options where you pay for a set amount of time over 10, 25 or 30 years. Here’s the criteria for standard repayment

Most doctors would be on a 25 year term.

Repayment Assistance Plan (RAP): What to Expect

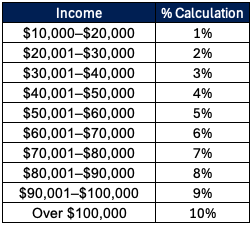

A new income-based repayment plan named Repayment Assistance (RAP) plan is created allowing enrollment starting July 1, 2026. This would be the only Income-Driven Repayment option for any current and future borrowers. RAP bases payments on adjusted gross income rather than discretionary income. Dual earning couples can exclude spousal income by filing as a couple married filing separately. RAP deducts $50 per monthly payment per child (2 children =$100 deduction). The percentage of income RAP utilizes to calculate your payment is based on your income.

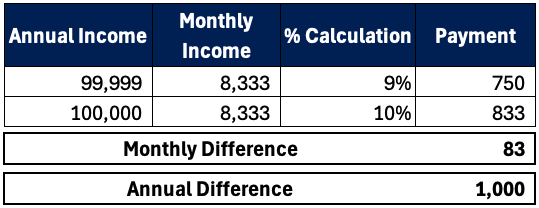

A notable difference between RAP and the previous income-driven plans is the payment cliff. If for example your income is $99,999 your payment is calculated on 9% of income. If your income is $1 dollar higher at $100,000, it bumps your payments up to 10% of income. Making $1 extra dollar bumps up your payment $83 p/mo and $1000 for the year!

A $10 minimum monthly payment is required, even for the lowest earners, unlike some current IDR plans (e.g., IBR) that allow $0 payments for incomes. Once you are enrolled in RAP, you cannot switch to another federal repayment option. This limits your flexibility to switch plans when you could do so with legacy IDR plans.

Similar to the previous REPAYE and SAVE plans, there is an interest subsidy with RAP. If your monthly payment does not cover the accrued interest, the government would waive the unpaid interest. This prevents your loan from growing higher when you move into repayment. In addition, the gov’t will provide a $50 monthly subsidy to ensure your principal balance decreases by at least that amount each month. Even if your required monthly payment is not sufficient to cover the interest or principal.

Suppose you owe $100,000 at a 6% interest rate. Your monthly interest accrual is $500. You are a low income earner with a required monthly payment of $100. In RAP, your $100 payment is not enough to cover the interest and the government would waive the excess unpaid interest of $400. Also, it would lower your loan’s principal balance from $100,000 to $99,950.

Here’s another example. You have the same loan balance and interest rate. But your income has increased resulting in monthly payments of $900 per month. The first $500 of your payment would cover the interest and the excess $400 would pay down the principal. Your loan balance decreases from $100,000 to $99,600.

RAP has loan forgiveness options. It qualifies for the PSLF program if you are working at a qualifying employer and for those not working at nonprofits it qualifies for forgiveness after you’ve made 360 months of payments. Old IDR plans had shorter repayment periods over 240-300 months. The loan balance forgiven on the 30 year track is taxable.

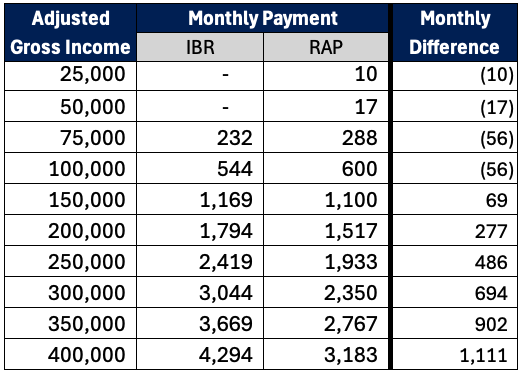

The jury is still out on if RAP will be superior to IBR for current borrowers. In the meantime, here’s a table calculating monthly payments in RAP and IBR for comparison. Assume this borrower is married in a single earning household with 3 children.

The OBBBA could entirely transform your loan strategy. If you’re struggling with how to manage your loans or what to understand the changes for your unique situation, schedule an appointment with one of our student loan experts today!

Are you ready to tackle your student loans?

Join our community of doctors, dentists and high earners. Each month you’ll get our FREE newsletter with all the tips and tricks to help you save $$ on your student loans.